Last Updated on May 23, 2025 by admin

Introduction: Why Rent Reporting Matters More Than Ever

In 2025, establishing and maintaining a good credit score is an important aspect of financial wellness. Yet, many renters still struggle to build credit simply because their largest monthly expense—rent—is not automatically reported to credit bureaus. That’s where rent reporting services come in.

These services bridge the gap, turning rent payments into credit-building opportunities. Whether you’re a young adult just discovering what credit really is, a long-time renter with limited credit history, or someone looking to rebuild, rent reporting in 2025 could be a game changer.

What Are Rent Reporting Services?

The Basics

Rent reporting services act as intermediaries between tenants, landlords, and credit bureaus. When you pay rent, these services report your payments to one or more of the major credit bureaus—Equifax, Experian, and TransUnion.

Why They Matter in 2025

As of 2025, more landlords and property managers are partnering with rent reporting companies, and major credit bureaus increasingly accept rent data as a reliable credit indicator. This makes now an ideal time to explore how these services can help you build or improve your credit.

How Rent Reporting Builds Credit

On-Time Payments = Positive History

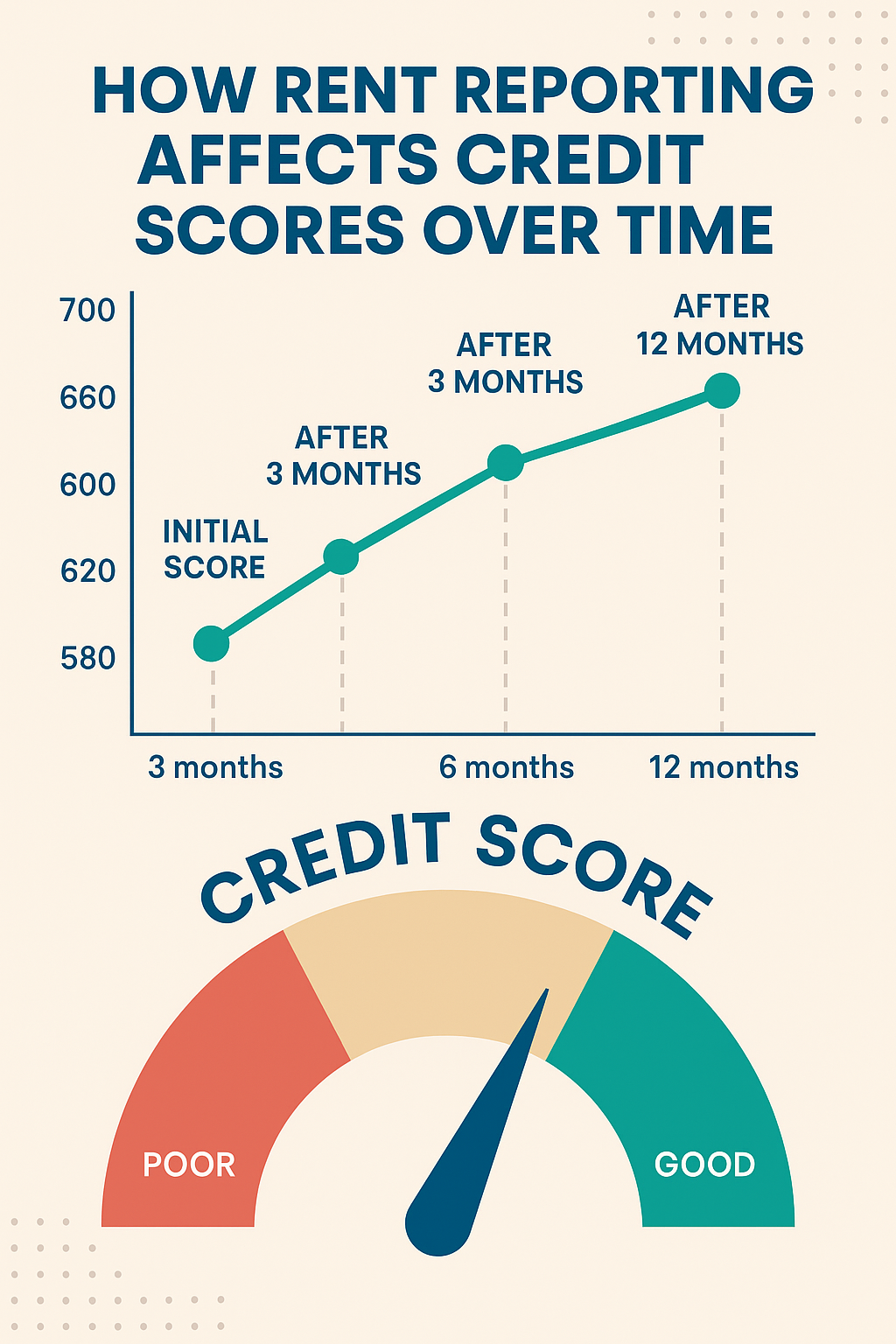

Just like a credit card or loan, consistent on-time rent payments build a positive credit history. Over time, this can significantly boost your score.

Length of Credit History

If you’re new to credit, rent reporting can help establish a longer credit history, which is a key factor in most credit scoring models.

Credit Mix

Adding rent to your credit profile diversifies your credit mix, another important scoring factor.

Learn How to Check Your Credit Score for Free in 2025

Best Rent Reporting Services in 2025

Here are the top-rated rent reporting companies making waves in 2025:

1. Rental Kharma

- Reports to: TransUnion

- Pros: Affordable, easy setup, no landlord involvement required

2. RentReporters

- Reports to: TransUnion and Equifax

- Pros: Historical data available (up to 2 years), excellent customer service

3. LevelCredit (formerly CreditPop)

- Reports to: TransUnion and Equifax

- Pros: Also tracks utilities, real-time payment tracking

4. Esusu

- Reports to: All three major bureaus

- Pros: Fully automated, popular with large property management firms

5. Piñata

- Reports to: TransUnion

- Pros: Free option available, cash back rewards for rent payments

How to Get Started with Rent Reporting

Step 1: Choose the Right Service

Consider your budget, which credit bureaus you want to report to, and whether your landlord needs to be involved.

Step 2: Enroll and Link Your Rent Payments

Once you sign up, you’ll typically need to verify your lease and set up a link to your rent payment method.

Step 3: Monitor Your Credit

Use a free service or app to track changes to your credit score over time. Improvement may take 1–3 months.

Real-Life Success Story

Meet Aisha, 29, from Atlanta: After struggling to get approved for a credit card, Aisha signed up with Rental Kharma. Within six months of having her rent reported, her credit score increased by 78 points. She now qualifies for a low-interest car loan and was recently approved for her first rewards credit card.

Final Thoughts: Is Rent Reporting Right for You?

If you’re already paying rent, why not make it work for you? Rent reporting services in 2025 are more accessible, affordable, and effective than ever. With minimal effort, you can transform routine payments into meaningful progress toward your financial goals.

By selecting a reputable provider and staying consistent, you’re not just paying rent—you’re building your future credit.